Things to know about dividends

As the Earnings session kicks in, stock market traders and investors expect the financial results of their companies as well the monetary payouts in the form of dividends, though this reward mechanism of companies exist for a long time, investors are still in the dark about dividends. This blog post will give a clear idea about stock market investing and benefiting from dividends.

What are dividends?

Dividends are monetary payouts given by companies to its share holders, usually from the company’s profits. But some times, companies facing losses will also give dividends to keep the investors interested. In India, various PSUs and PSBs in which the government own majority stakes, pay dividend regularly. These stocks come under the category of value stocks, whereas many companies owned by privates, generally do not payout dividends. They concentrate on capital appreciation and fall under growth stocks category. Though companies pay dividends, make sure it is not mandatory for companies to give dividends.

The Record date, Ex dividend date and payout date:

Companies set formal dates for declare dividends, the record date is the date in which companies check for the list of eligible shareholders with depository participants of stock market structure namely CDSL and NSDL. The shareholders who have the companies shares on the record date will be given payments.

Note that settlement of shares follow T+1 cycle in India and so it is advised to buy shares at least two days before the record date, to qualify for receiving dividend.

The EX dividend date is the date in which the stock starts to trade without the dividend value. Lets suppose, a stock in Nifty, ITC trades at Rs. 300 and gives a dividend of Rs.5, the share price will become Rs 295 on ex date. .

This ex date is set usually two days before the record date and so buying a share for dividend alone does not make sense. The prices of derivatives will also be adjusted in case of Special dividends, where dividend given is above more than 2% of CMP of stock. Adjustments will be make to reduce the respective strike prices of options by the dividend amount.

Dividend yield:

It is the ratio between total dividend amount received to the current price of the stock. Some PSU stocks give yields as high as 5℅, this form of investment will give interests offered by banks as well as an opportunity for capital growth.

Before 2020, Dividends received were considered to be non taxable income, from the year 2021, dividends received will be taxable at the receivers end if the dividend received is above Rs 5000 from a single company in a financial year and the tax will be deduced before the amount is paid out.

People can look at dividends as a second source of income and that as a way of generating generational wealth.

Conclusion

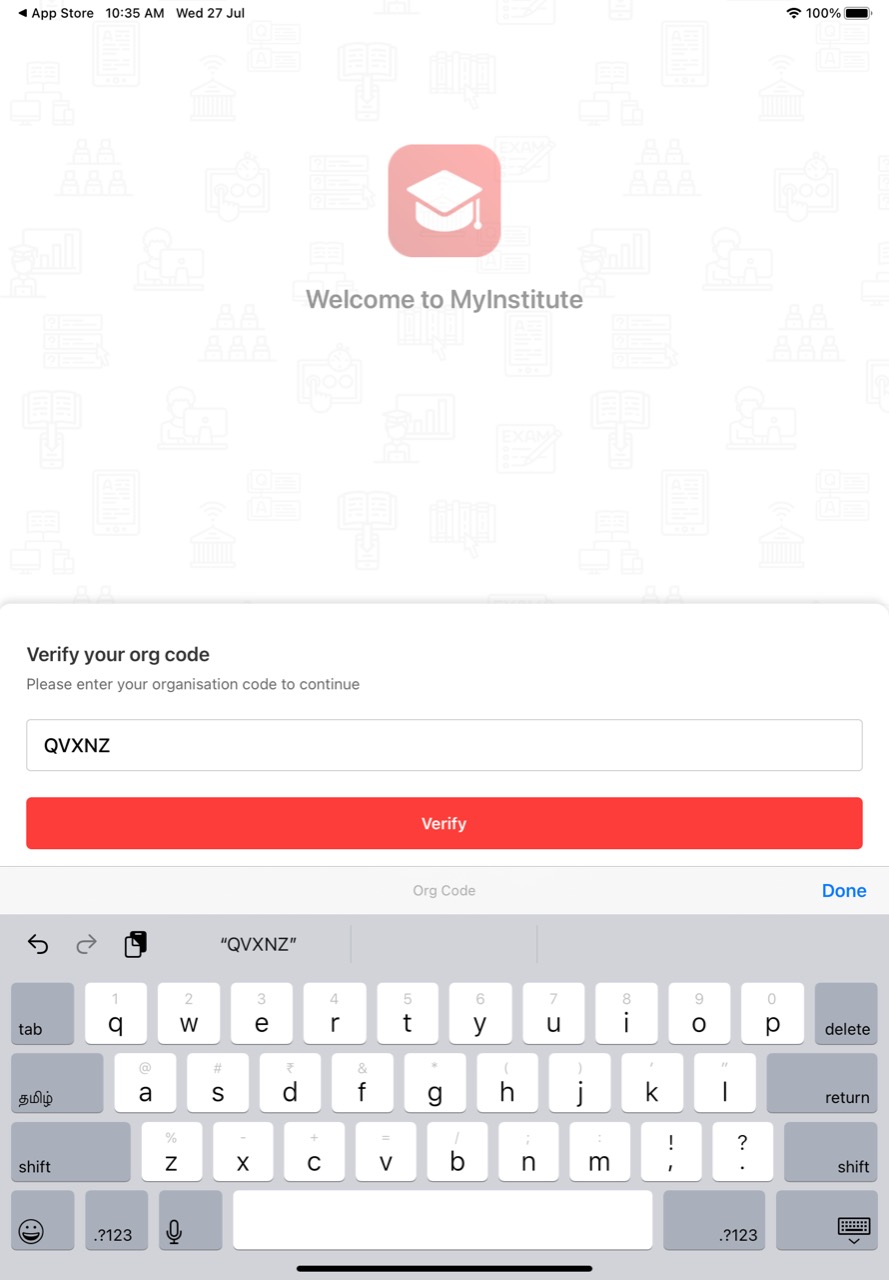

So, investing in proper stocks is a win-win if you choose the right stock so while your stock is performing in the markets, the stocks will be giving you dividends, while the stock is yet performing in the market. But you can’t just search for stocks that give dividends, because those stocks won’t be performing well in the markets, now you may ask, then how to find the right stock. That is where we come in, we teach people how to choose the right stock, when to enter, how to enter, how to find the market trend. Our subjects are personally cuts mixed with the rules & regulations formulated by our Founder & CEO Mr. K S Kishore Kumar, which he acquired from his 10+ years of experience in the Stock Market. That makes us one of the Best Financial Market Training Institute.

No Comments